In the world of property investment, timing and location are everything. For years, savvy investors have chased returns in established southern markets or crowded city centres. But today, a different region is quietly stepping into the spotlight, and those paying attention are already positioning themselves ahead of the curve.

That region is the North East of England.

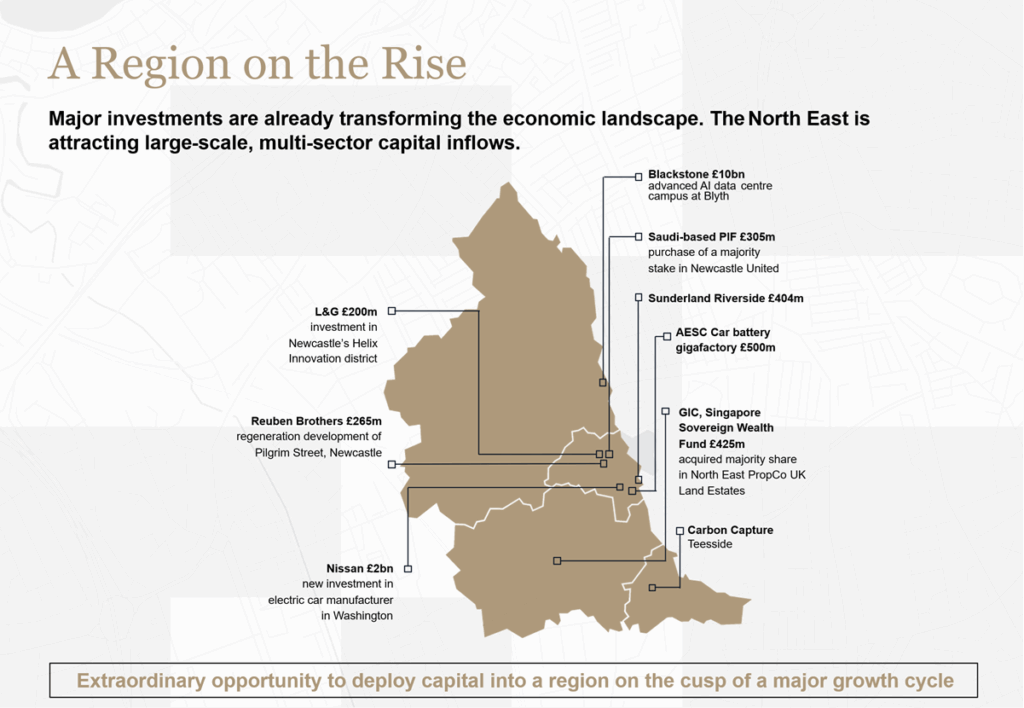

A Region on the Rise

The North East has long been home to strong communities, a proud industrial heritage, and some of the most affordable property in the UK. But what’s happening now is something altogether different: a wave of large-scale, strategic investment from both the public and private sectors, transforming the region’s economic landscape.

This isn’t speculative hype. It’s backed by billions in confirmed funding and a who’s-who of global institutional investors.

Blackstone is here. So is GIC (Singapore’s sovereign wealth fund), the Saudi Public Investment Fund, and the Reuben Brothers. Their confidence sends a clear message: the North East isn’t just investable — it’s investable at scale.

What’s Driving the Boom?

Several interlocking trends are powering the North East’s resurgence:

- Massive Infrastructure Investment: Major upgrades to road, rail, and clean transport networks are improving connectivity across the region.

- Green Energy & Clean Tech: Teesside is emerging as a world-leading clean hydrogen and carbon capture hub, attracting billions in investment.

- Advanced Manufacturing: Nissan’s £2bn expansion into EV production and Envision’s gigafactory are reshaping Sunderland’s economy.

- AI and Innovation Hubs: Newcastle is home to one of Europe’s most ambitious AI centres, supported by UK government and private funding.

- Housing & Regeneration: From Sunderland’s riverside masterplan to Middlesbrough’s town centre revitalisation, new homes and communities are being built at pace.

In short, the North East is not just growing, it’s transforming.

Why This Matters for Property Investors

When regions undergo economic transformation, the property market responds. Jobs bring people, people need homes, and rising demand creates upward pressure on rents and prices.

The North East currently offers a rare blend of:

- Affordable entry points for residential property,

- Strong rental yields compared to southern markets, and

- Long-term capital growth potential tied to genuine infrastructure and economic drivers.

It’s no wonder institutional investors are already moving in. But unlike other markets, there’s still time for private investors to get ahead of the crowd.

Homes or Houses: On the Ground, In the Know

At Homes or Houses, we’ve always believed in the North East. It’s where we’re based, where our local teams operate, and where we’ve helped hundreds of clients build successful property portfolios, often remotely, and always with a hands-on approach.

Our knowledge of the region goes beyond the data. We know which postcodes are up-and-coming, which developments have legs, and where demand is consistently strong. And now, with the landscape shifting at pace, we’re helping clients tap into this growth in two key ways:

- Direct property sourcing and management, for those building buy-to-let portfolios, and

- Asset Manager to a regulated North East property fund, for those looking for a more hands-off investment route (more on this soon).

Want to Learn More?

We believe the North East is the UK’s smartest investment region right now. And we’re here to help you access it, with insight, integrity, and practical support every step of the way.

Get in touch with us to discuss how we can help.